Presented on the occasion of the 34th edition of Linkontro, an event dedicated to the consumer business

community in Santa Margherita di Pula, in the province of Cagliari, the results of the Nielsen survey on

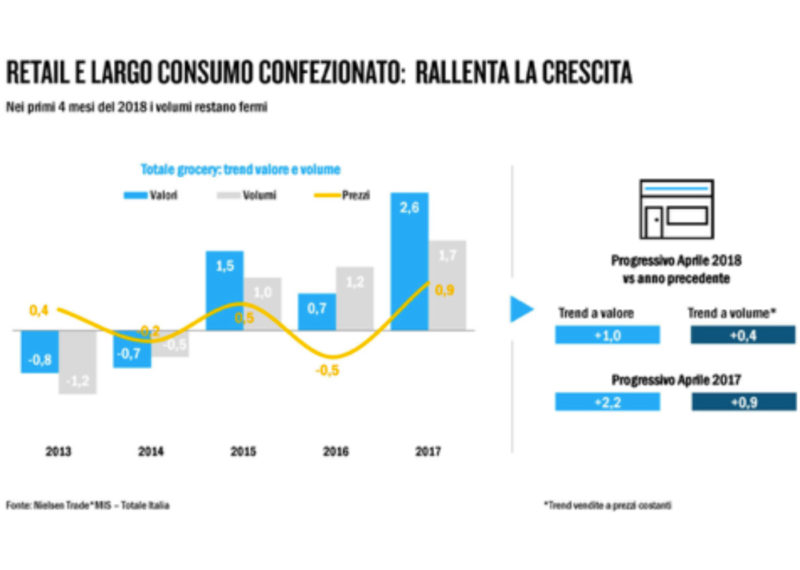

Italian consumption in early 2018: changes the composition of the shopping cart but not the volume, given

that the turnover recorded only a 1% increase in turnover and an increase of 0.4 in volumes compared to

the same period in 2017, but with a differentiation in the variety and type of products purchased.

Green, healthy and gourmet products increase at the expense of traditional dishes with consumer purchase

choices dictated by the satisfaction of a wider range of needs compared to the past. Attention to wellbeing,

intolerance and social responsibility have led to an important growth of products that certify their

peculiarity directly on the packaging.

With regard to the relationships between brands, the sales growth of the Distributor Brand (MDD) and

small brands continues, while the largest continue to lose ground, thus generating an ever-increasing

fragmentation of consumer goods.

With regard to sales channels, in the period from January to May 2018, compared to the same period of

2017, discounters saw a growth in sales at value (at the same network) of + 1.5%, while supermarkets

recorded a decline in 0.9%, the hyper ones of 3.3%. E-commerce accounts for 1.5% of food sales, and grows

at double digits.

Commenting on the results of the survey, the CEO of Nielsen Italia, Giovanni Fantasia, said: We can not

avoid the fact that we are facing a more contained trend in the growth process, both in terms of volumes

and values, while remaining in positive territory. . By analyzing the reasons behind this trend, we are of the

opinion that Italy, like the rest of the big economies, has emerged from a period of ten-year crisis. On the

other hand, the path that awaits us is not without obstacles. Think, for example, of the large pockets of

poverty still present on the national territory and the accentuation of the polarization of social status. It is

therefore necessary that the world of retailing knows how to face the challenge of an increasingly varied

shopping cart, full of products that come from the perimeter of ordinary consumption (traditional first

courses and first and second courses) and that reveal more personalized consumption habits and less

expected that do not necessarily comply with the logic of expected volumes within a favorable economic

situation. Finally, we can not disregard a socio-economic context that is not without uncertainties. To be

able to leverage the growth process, it is therefore necessary to adhere to the needs of consumers, taking

into account the complexity of the factors involved when deciding to purchase a product».